Financing an ADU is hard.

With Imkat it’s Easy.

- Get lower rates based on the future value of your home.

- Pay early without prepayment penalties.

- Choose between fixed rate and variable rate home equity loan and HELOC options.

Financial Flexibility for Your ADU Project

IMKAT Homes understands that financing your ADU can be a significant step, and we’re here to help make it accessible and stress-free. Explore flexible options to turn your vision into reality without breaking your budget.

Benefits of our financial solutions:

- Competitive loan rates tailored for ADU construction.

- Assistance with financing applications and approvals.

- Transparent terms with no hidden costs.

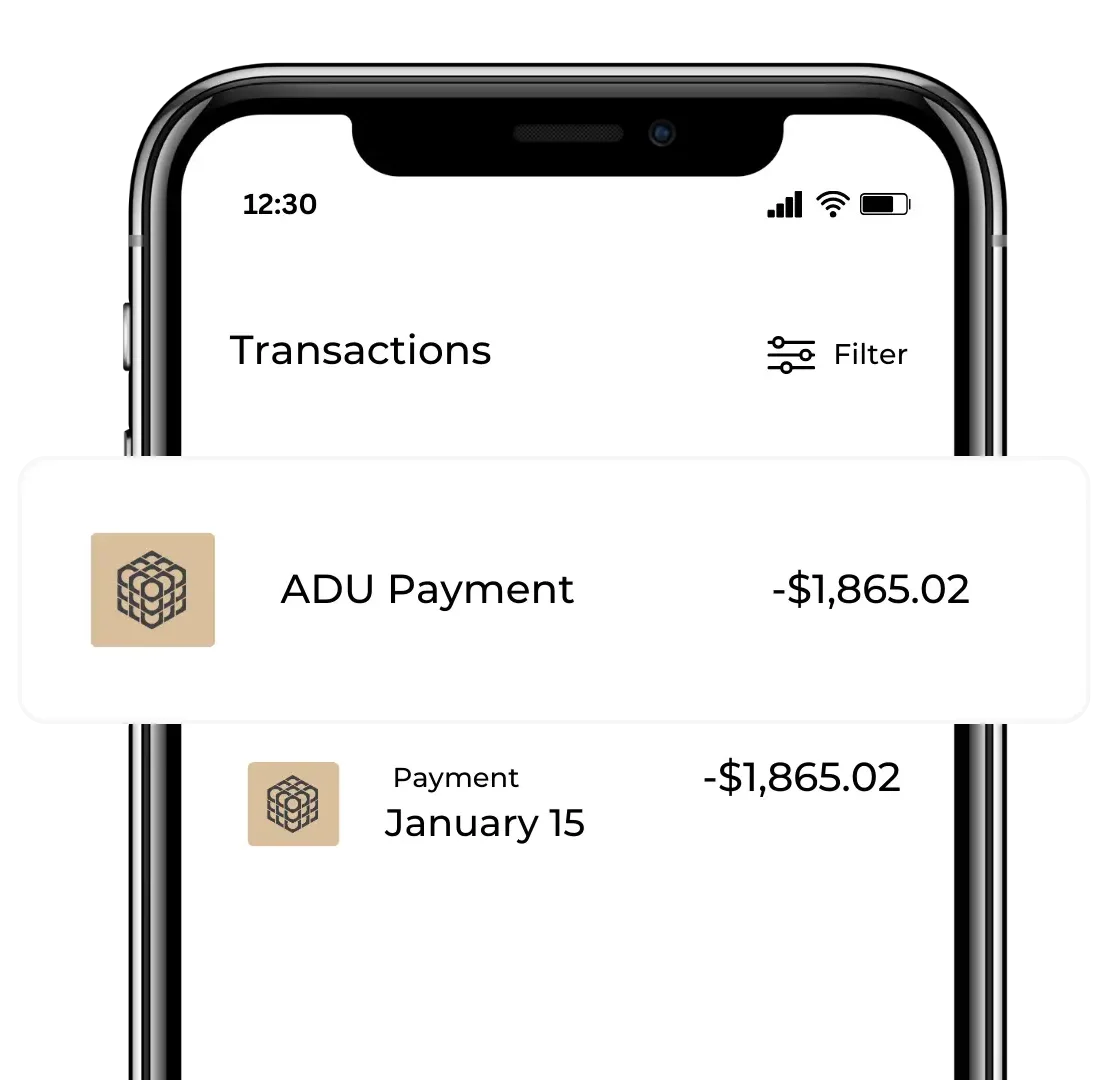

What you could pay:*

IMKAT Homes

$1,500/mo

- 7% APR

- 30 year term

Other ADU financing

$2,790/mo

- 9.5% APR

- 20 year term

Discover the affordability of transforming your property with our Accessory Dwelling Units (ADUs). IMKAT Homes provides transparent pricing tailored to your unique project needs. Costs may vary based on design complexity, materials, and site conditions, but we ensure competitive rates without compromising on quality. Our team works closely with you to create a budget-friendly plan while maintaining the highest standards in construction and design. With our commitment to upfront communication, you’ll know exactly what to expect, eliminating surprises. Start your journey towards a stunning, functional ADU today—your dream space is more achievable than you think!

Why our ADU loan is the best loan for your ADU:

|

Financing for IMKAT ADU |

Standard Cashout Refi |

Home Equity Line of Credit |

Construction Loan |

|

|---|---|---|---|---|

|

Loan Based on the After Renovation Value |

||||

|

Borrow up to 90% After Renovation Value |

||||

|

No Refinancing Options Available |

||||

|

Inspections and Draws not Required |

Financial Flexibility for Your ADU Project

Cash-out Refinance

This loan is typically used when you have substantial equity in your home and your current interest rate is near the prevailing rates. This is a first mortgage product and will replace your existing loan. Also used when a home is free and clear ( or close to free and clear) of any mortgages.

HELOC

This is a form of a 2nd mortgage. You get to keep your current mortgage with no change to any of it’s terms. The HELOC ( Home Equity Line of Credit) has a few different variations and is very popular with ADU building. This allows you to use your equity in your home on a “as needed” basis. Your monthly payment can be based on your monthly balance, similar to a credit card ( but generally with much lower rates than credit cards). Because payments are based on balance, this keeps the cost of the ADU lower during your construction phase.

HELoan

Also a 2nd mortgage but works very differently than a HELOC. This loan will give you the money for the project all at once. It can come in a fixed rate and is generally 20 years or less for a term. Full principal and interest payments will start immediately as the lender has deposited all the funds into your bank account.

Renovation loans

These allow for the added value of the ADU to be included when the lender looks at the amount of equity in your home. These loans can come in the form of Cash-out refinances, HELOCs and HELoans.

Construction Loans

This is a first mortgage product and will require replacing your existing first mortgage with today’s rates. Great for properties that don’t have any existing structures on them.

All of the above require using your home as collateral, there are a few options that won’t require this and are considered “Unsecured Loans”

Personal loan

Generally used for smaller projects ( under 100K) and/or to fill the gap when someone doesn’t have enough equity in the home for the whole project.

Retirement funds

Check with your provider to see if there are any penalties associated with taking money out as a withdrawal or as a loan.

Sell an existing property

Take a HELOC out on your existing property, once the ADU is built you can sell the property and payoff the HELOC

Our ADU Partner: Renofi

Finance Your ADU!

Get Pre-Approved Today

Finance Your ADU!

Get Pre-Approved Today